Business Insurance in and around Riverdale

Calling all small business owners of Riverdale!

Helping insure small businesses since 1935

Coverage With State Farm Can Help Your Small Business.

Whether you own a a window treatment store, a confectionary, or an antique store, State Farm has small business insurance that can help. That way, amid all the various decisions and moving pieces, you can focus on navigating the ups and downs of being a business owner.

Calling all small business owners of Riverdale!

Helping insure small businesses since 1935

Insurance Designed For Small Business

When one is as driven about their small business as you are, it is understandable to want to make sure everything is in order. That's why State Farm has coverage options for commercial liability umbrella policies, commercial auto, worker’s compensation, and more.

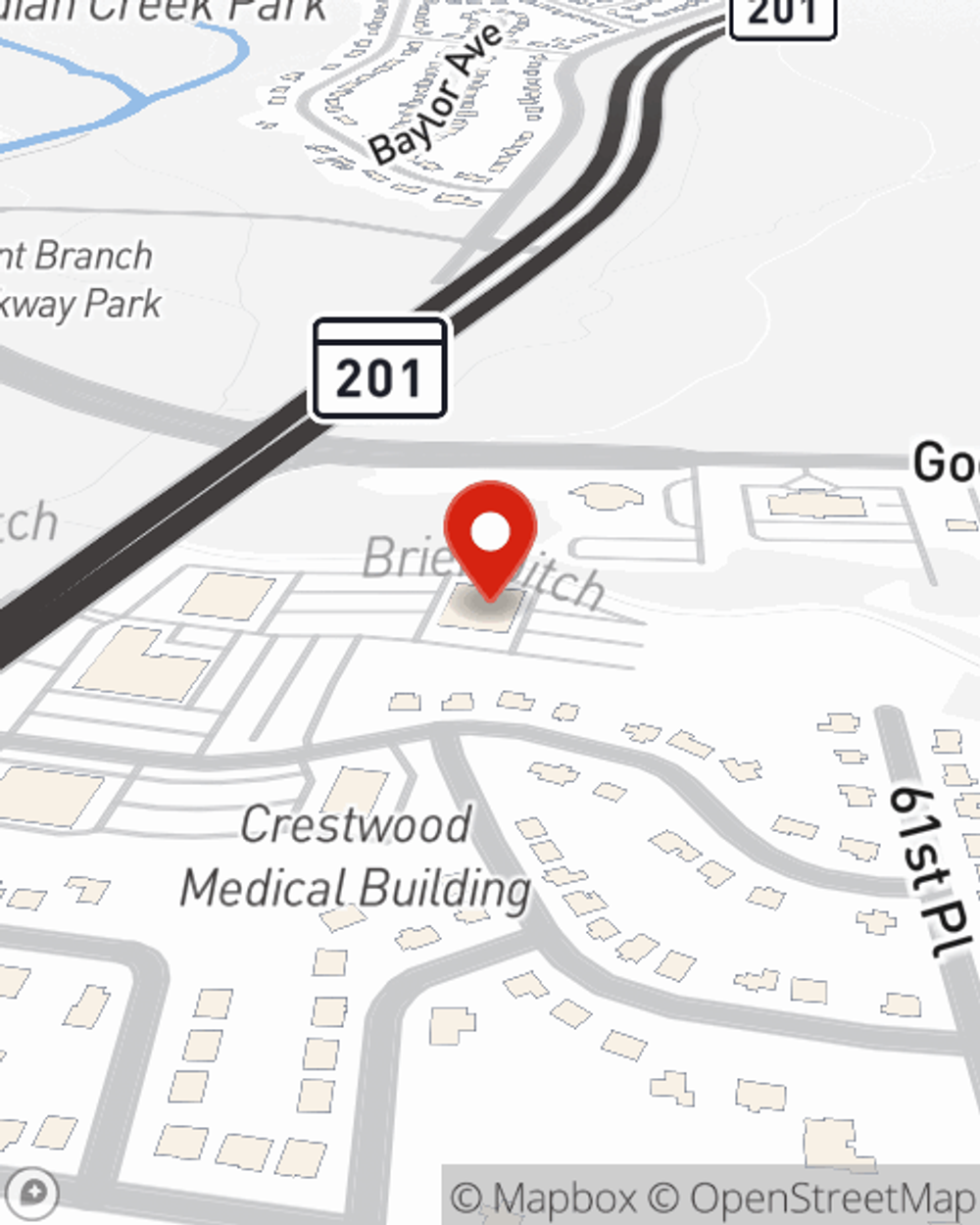

The right coverages can help keep your business safe. Consider contacting State Farm agent Hope Bell's office today to discuss your options and get started!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Hope Bell

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.